39 advantage of zero coupon bonds

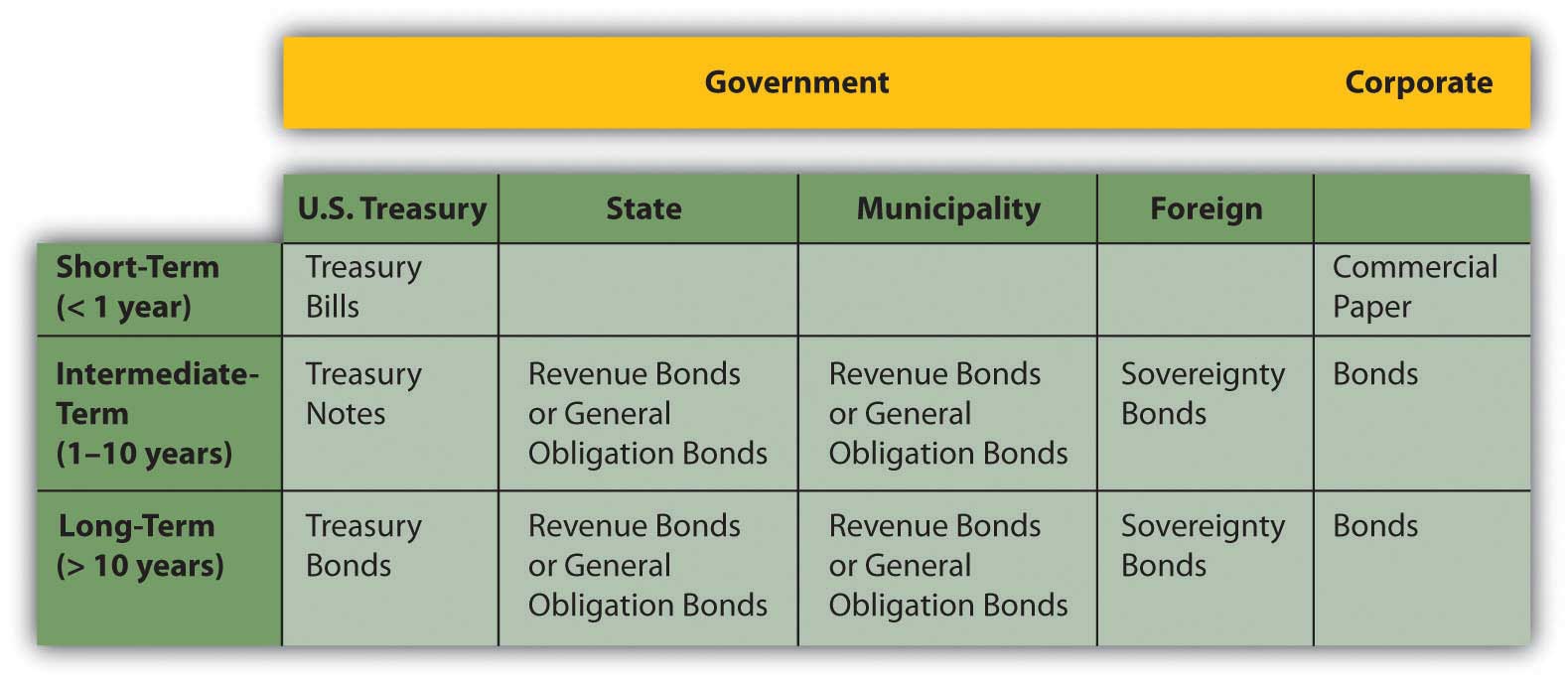

Warrant (finance) - Wikipedia In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price.. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. Both are discretionary and have expiration dates. They differ mainly in that warrants are ... How to Invest in Bonds - The Motley Fool 12/09/2022 · Treasury bonds: Nicknamed T-bonds, these are issued by the U.S. government. Because of the lack of default risk, they don't have to offer the same (higher) interest rates as corporate bonds.

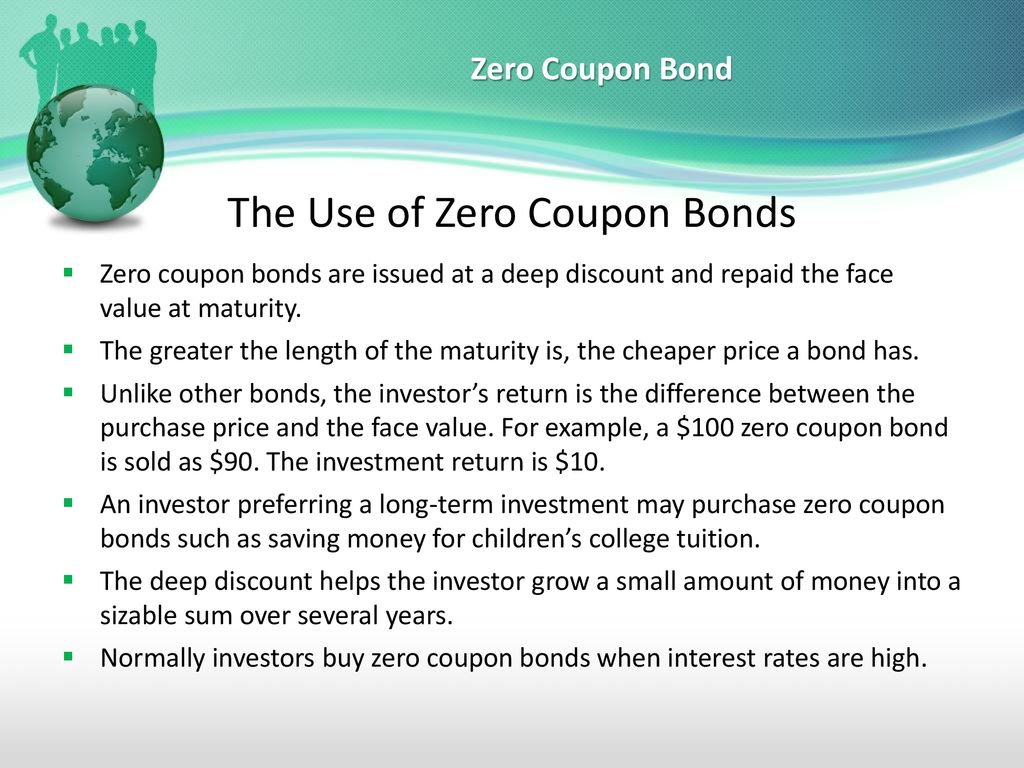

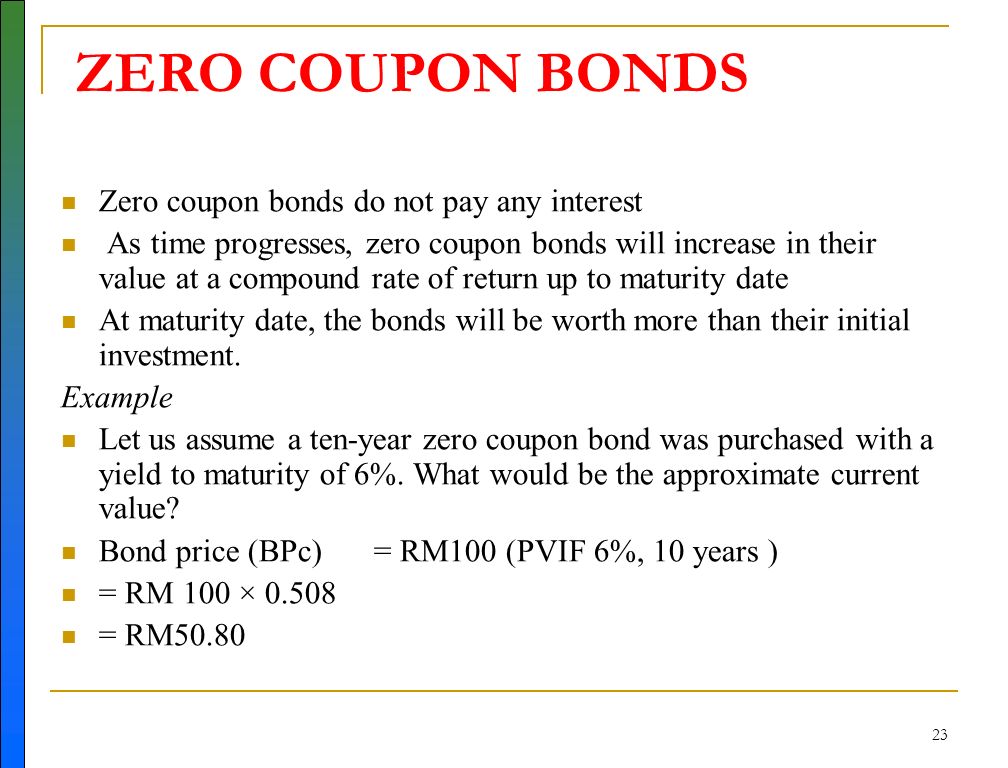

Government Bonds: Types, Benefits & How to Buy ... - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. ... Sovereign Guarantee is the major advantage for investors buying Government Bonds. Assured Returns. Investors ...

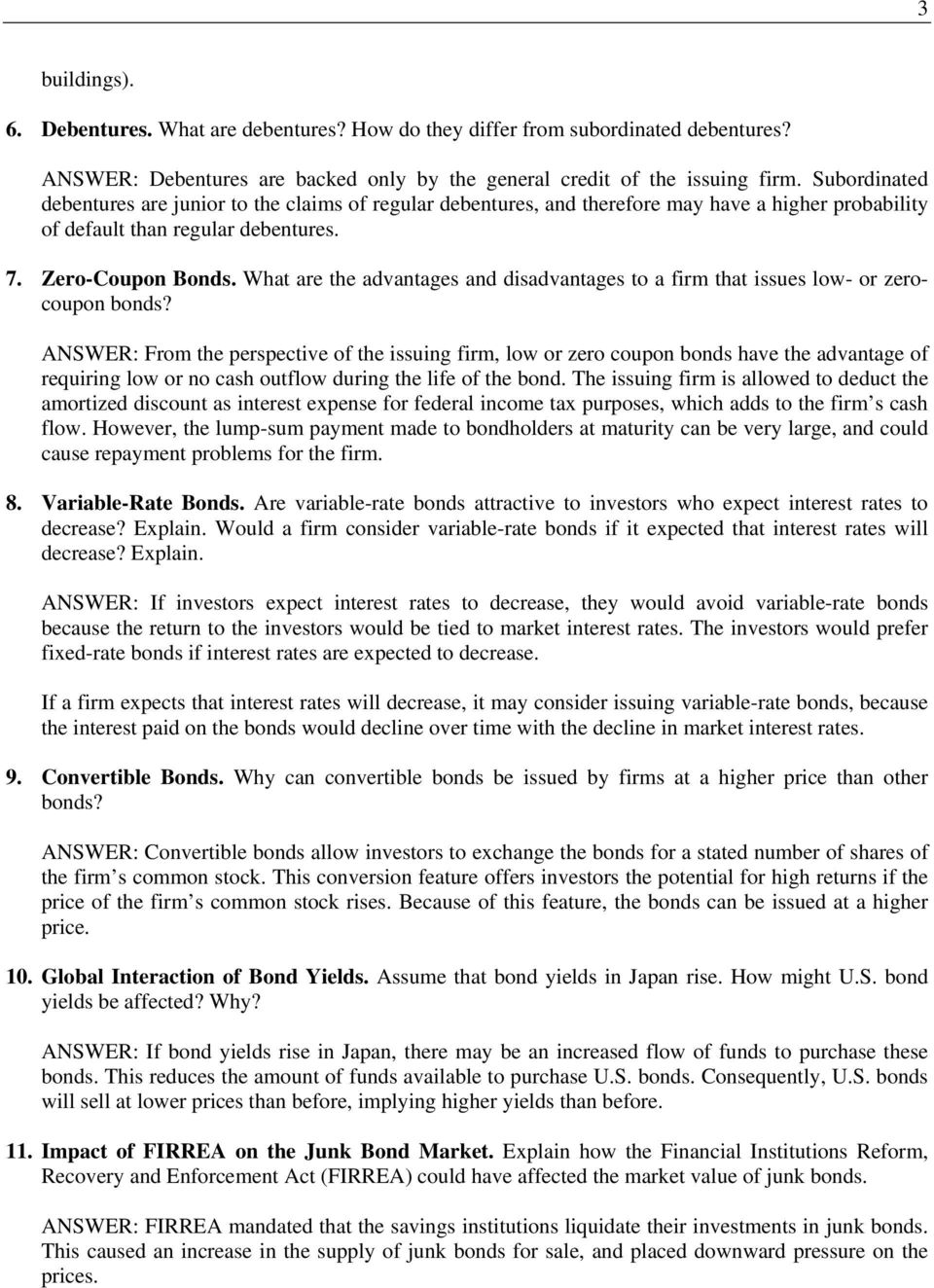

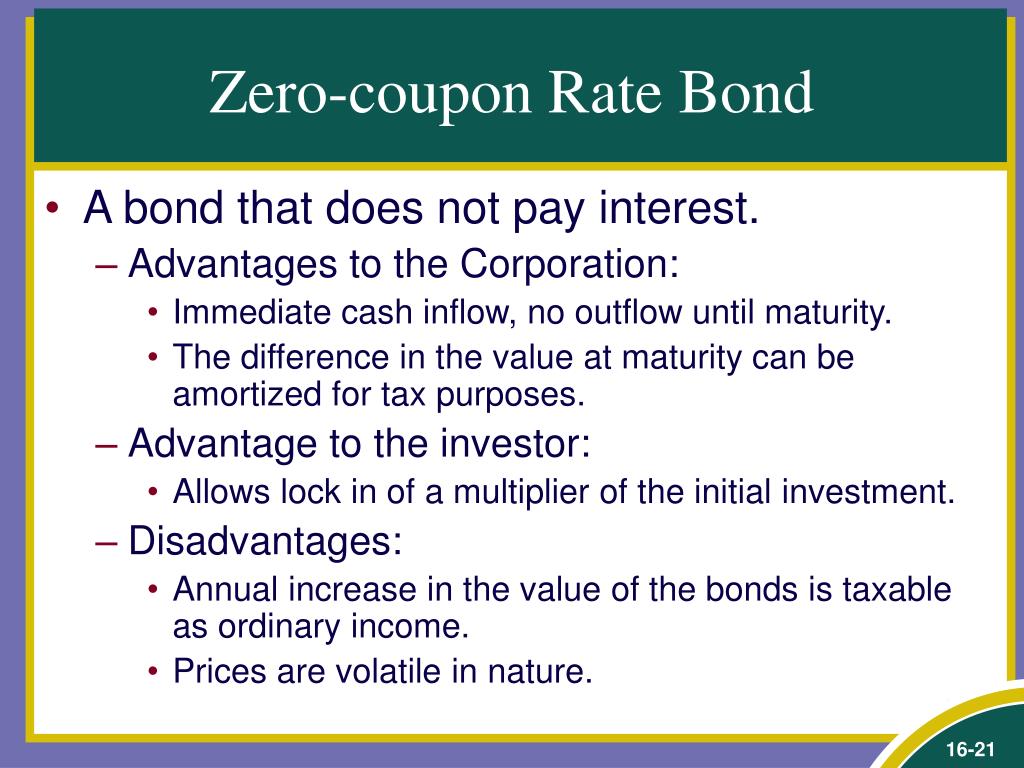

Advantage of zero coupon bonds

Bond Yield to Maturity Calculator for Comparing Bonds Tax Exemptions – Specific types of bonds can provide a tax advantage to investors. For example, when a government or local municipality issues bonds to subsidize public works, the interest earned by the bond holder is often tax exempt. ... Zero Coupon Bonds. This is simply any type of bond, government or corporate, that makes no interest ... US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

Advantage of zero coupon bonds. How Are Municipal Bonds Taxed? - Investopedia Jan 17, 2022 · The biggest and most obvious benefit of zero-coupon bonds is that you’re buying the bond at a big discount to its face value. This is also known as the original issue discount or OID. For ... Government Bonds: UK Gilts Explained | CMC Markets Government bonds in the UK are now being released with an 8% coupon. As your coupon is only 5%, demand falls for your bond, reducing its value to £95. If interest rates fall… the cost of borrowing reduces. Government bonds in the UK are now being issued with a 3% coupon. Our 5% coupon is now worth more than the new coupons. Corporate Bonds - Fidelity Zero-coupon Zero-coupon corporate bonds are issued at a discount from face value (par), with the full value, including imputed interest, paid at maturity. Interest is taxable, even though no actual payments are made. Prices of zero-coupon bonds tend to be more volatile than bonds that make regular interest payments. Callable and puttable Understanding Bonds: The Types & Risks of Bond Investments Because bonds tend not to move in tandem with stock investments, they help provide diversification in an investor's portfolio. They also provide investors with a steady income stream, usually at a higher rate than money market investments Footnote 1. Zero-coupon bonds and Treasury bills are exceptions: The interest income is deducted from their purchase price and …

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount . Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. Bond Yield to Maturity Calculator for Comparing Bonds Tax Exemptions – Specific types of bonds can provide a tax advantage to investors. For example, when a government or local municipality issues bonds to subsidize public works, the interest earned by the bond holder is often tax exempt. ... Zero Coupon Bonds. This is simply any type of bond, government or corporate, that makes no interest ...

:max_bytes(150000):strip_icc()/savings-bonds-vs-cds-which-better-2016.asp_V1-4754e38f62f64fc7bb19a06de61c8817.png)

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Post a Comment for "39 advantage of zero coupon bonds"