42 present value of coupon bond calculator

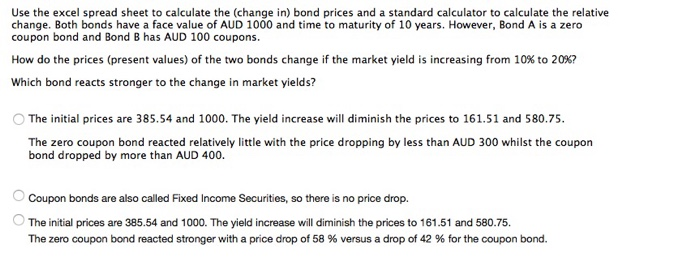

› calculate › bondBond Calculator (P. Peterson, FSU) The purpose of this calculator is to provide calculations and details for bond valuation problems. It is assumed that all bonds pay interest semi-annually. Future versions of this calculator will allow for different interest frequency. BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF - BondBloxx ... $39.90 AS OF DATE* 09/14/2022 EXPENSE RATIO 0.29% AS OF DATE* 09/14/2022 FUND NET ASSETS $177.54M AS OF DATE* 09/14/2022 Overview The BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated emerging market bonds with an average life of below 10 years.

Weekly Forecast, Sept. 9, 2022: Peak In 1-Month Forward Treasury Rates ... The forward 1-month U.S. Treasury yield now peaks at 4.98%, up 3 basis points from last week. As explained in Prof. Robert Jarrow's book cited below, forward rates contain a risk premium above and ...

Present value of coupon bond calculator

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.143% yield. 10 Years vs 2 Years bond spread is 46.1 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.40% (last modification in August 2022). The India credit rating is BBB-, according to Standard & Poor's agency. Buy I Bonds in September 2022 at 9.62% | Keil Financial Partners Your $100 would turn into $104.81 6 months later, and still be worth $104.81 at the end of month 12. If the rate 12 months from now is not to your liking, then you could cash out your I bond in 12 months, lose the 3 months prior interest (which would be 0%), and still have $104.81. That's a 4.81% rate over the next 12 months! What Is a Zero-Coupon Bond? - The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 =...

Present value of coupon bond calculator. JOHNSON & JOHNSONLS-NOTES 2007(07/24) Bond - Insider The Johnson & Johnson-Bond has a maturity date of 11/6/2024 and offers a coupon of 5.5000%. The payment of the coupon will take place 1.0 times per Year on the 06.11.. Botswana Government Bonds - Yields Curve The Botswana 10Y Government Bond has an estimated 6.854% yield. Its value is not derived from the market, but it's calculated according to the yields of other available durations. Central Bank Rate is 2.65% (last modification in August 2022). The Botswana credit rating is BBB+, according to Standard & Poor's agency. NIFTY Put Call Ratio | NIFTY pcr today - Nifty Invest On 5 Sept NIFTY was trading at 17665.9 with pcr value 1.08. On 6 Sept NIFTY was trading at 17655.6 with pcr value 1.01. On 7 Sept NIFTY was trading at 17624.4 with pcr value 1.1. On 8 Sept NIFTY was trading at 17798.75 with pcr value 1.17. On 9 Sept NIFTY was trading at 17833.35 with pcr value 0.89. Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... A $5000 bond is worth 200 times what a $25 bond is worth; a $100 bond is worth 4 times what a $25 bond is worth. If you have a $80 electronic bond at TreasuryDirect, it is worth 3.2 $25 bonds. The $25 bond value is always rounded to the nearest penny. Thus, a $5000 bond must always have a value that is a multiple of $2.00.

ICE BofA US High Yield Index Effective Yield - St. Louis Fed Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify ... Treasury Bills | Constant Maturity Index Rate Yield Bonds ... - Bankrate Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers. BondBloxx B Rated USD High Yield Corporate Bond ETF - BondBloxx® ETF BondBloxx B Rated USD High Yield Corporate Bond ETF Download Prospectus Document Library Download Factsheet Net asset value $ 39.71 AS OF DATE* 08/29/2022 EXPENSE RATIO 0.30 % AS OF DATE* 08/29/2022 FUND NET ASSETS $11.91M AS OF DATE* 08/29/2022 Overview Fund Information Portfolio Holdings Performance Overview What Are ESG Bonds? - The Motley Fool An ESG bond is a type of debt security. A debt security means that the issuer owes the holder a debt and is obligated to pay the principal and interest at a set maturity date. Bonds are a type of ...

91 Day T Bill Treasury Rate - Bankrate 91-day T-bill auction avg disc rate. 3.08. 2.61. 0.05. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a discount ... Government Bonds - Meaning, Types, Advantages & Disadvantages - Scripbox The nominal value of the bond is calculated based on the previous week's simple average closing price of 99.99% of purity gold. India Bullion and Jewellers Association Ltd (IBJA) publishes the price list. The denomination of these bonds is in terms of one gram of gold. Current US Yield Curve Today (Yield Curve Charts)| GuruFocus The GuruFocus Yield Curve page contains the following sections: Header, Current Yield Curve, Historical Yield Curve and Yield Curve Definition. The Header section gives you the one-month yield, the one-year yield, the 10-year yield and the 30-year yield as of the current date. On the other hand, the Current Yield Curve section contains two charts. › Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

Tips for investing in real estate for your retirement His optimal mix in a retirement portfolio: 50 percent real estate, 30 percent stock, and 20 percent bonds, a formula he said would be sufficiently diversified to provide stability in retirement.

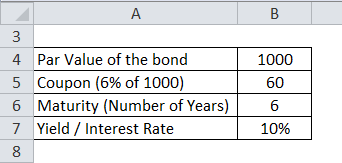

Annuity - BrainMass We use time value of money concepts, such as present value and future value, to value this stream of payments. A perpetuity is an annuity that continues forever - or at least indefinitely into the future. ... For working capital your company has issued $1,500,000 in new bonds. The bonds have a stated 10% coupon rate with 5 annual interest ...

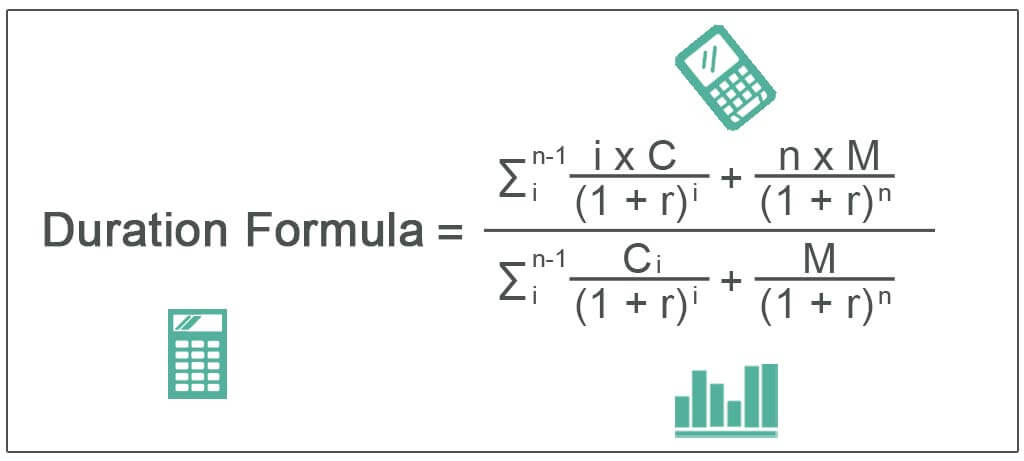

Methods Of Estimating Value | Seeking Alpha There is a calculation to overcome this obstacle, called the perpetuity method of terminal value. Investors use DCF to calculate the forecast period, usually 10 years, then add a terminal value ...

› present-value-formulaPresent Value Formula | Calculator (Examples with Excel Template) Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ...

Current Rates | Edward Jones 4.50%. $10,000,000 and over. 4.25%. Rates effective as of July 28, 2022 . The margin interest rate is variable and is established based on the higher of a base rate of 4.00% or the current prime rate. Our Personal Line of Credit is a margin loan and is available only on certain types of accounts.

What does a negative bond yield mean? - Investopedia To calculate, simply divide the annual coupon payment by the bond's selling price. For example, assume a $1,000 bond has a coupon rate of seven percent, which means that the bond pays $70 annually...

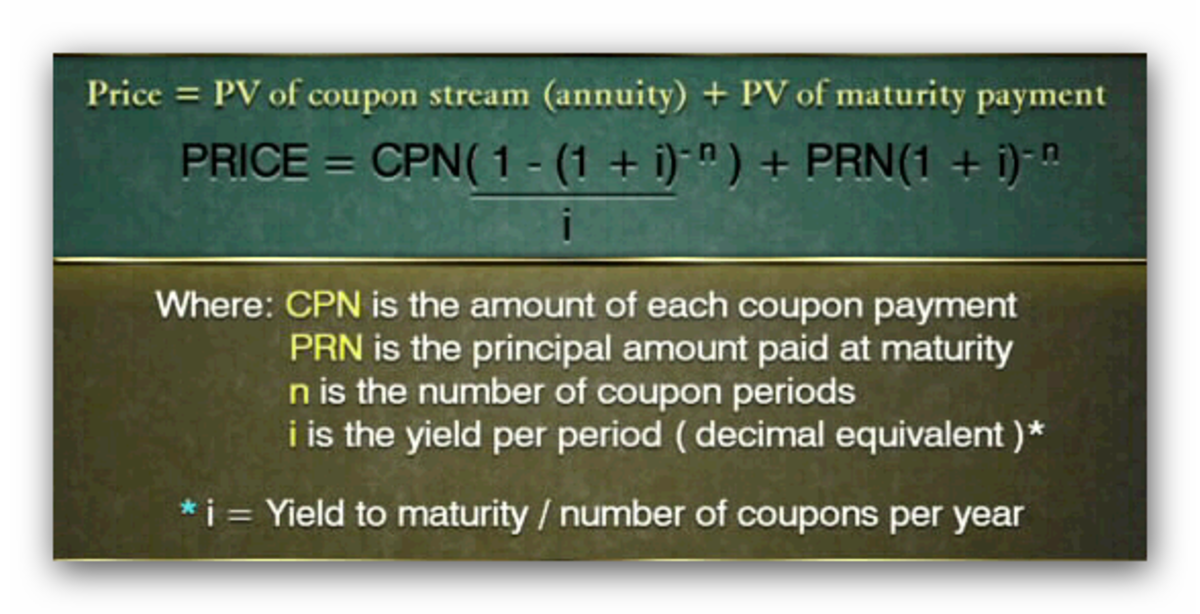

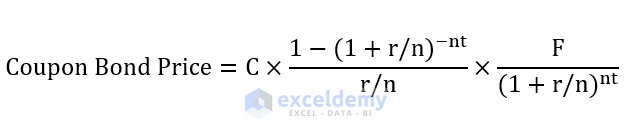

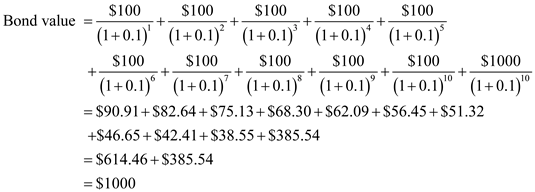

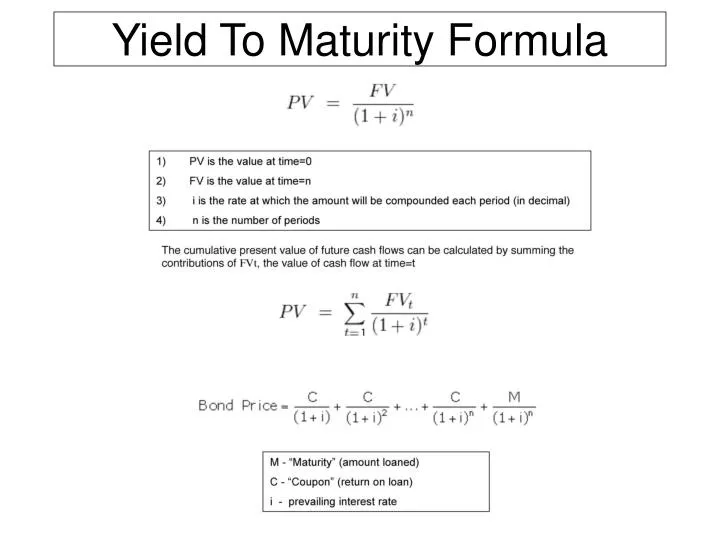

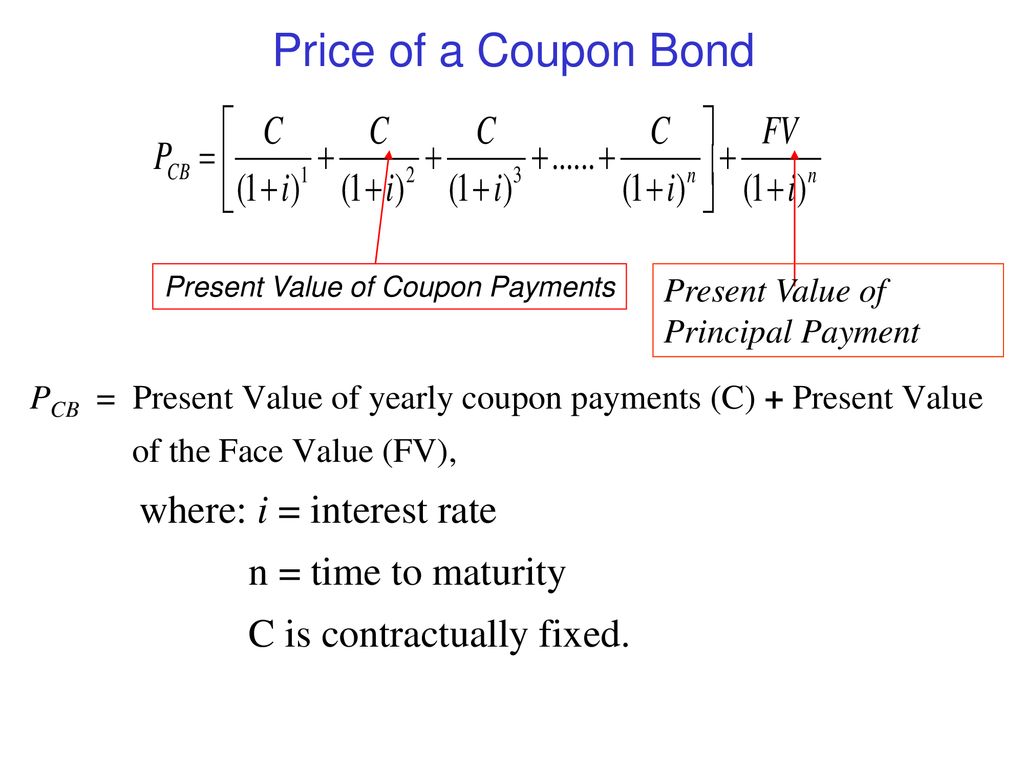

Bond Valuation Formula & Steps | How to Calculate Bond Value - Video ... A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,...

› bond-valueBond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par ...

› terms › pWhat Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

Loan Balance Calculator - TheMoneyCalculator.com Using our Loan Balance Calculator is really simple and will immediately show you the remaining balance on any loan details you enter. To use it, all you need to do is: Enter the original Loan amount (the full amount when the loan was taken out) Enter the monthly payment you make Enter the annual interest rate

How to calculate yield to maturity in Excel (Free Excel Template) The coupon rate is 6%. But as payment is done twice a year, the coupon rate for a period will be 6%/2 = 3%. So, pmt will be $1000 x 3% = $30. PV = Present value of the bond. It is the amount that you spend to buy a bond. So, it is negative in the RATE function. FV = Future value of the bond. It is actually the face value of the bond.

Daily Treasury Yield Curve Rates - YCharts Japan Government Bonds Interest Rates: Sep 13 2022, 19:30 EDT: Bank of Japan Basic Discount Rate: Sep 13 2022, 19:50 EDT: Euro Short-Term Rate: Sep 14 2022, 02:00 EDT: Spain Interest Rates: Sep 14 2022, 04:00 EDT: European Long Term Interest Rates: Sep 14 2022, 04:00 EDT: Sterling Overnight Index Average (SONIA) Sep 14 2022, 04:00 EDT

US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Coupon 3.00%; Maturity 2052-08-15; Latest On U.S. 30 Year Treasury. ALL CNBC INVESTING CLUB PRO. Short-term bond yields continue climbing, 2-year Treasury tops 3.8% 7 Hours Ago CNBC.com.

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The investor does not purchase a quantity of bonds, but instead a particular nominal amount. The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that ...

› calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Bond Issues | interest.co.nz Bond Issues. Indicative yields and prices as at 11:00 am, Sep 9, 2022. In the listings of bonds below the Government stock and swap rates, click on the maturity date to go to a full description of the bond and click on the issuer name to go to the issuer page. Fixed rate issues | Yearly reset issues | Floating rate issues.

Zero-Coupon Swap Definition - Investopedia The present value of each fixed and floating leg will be determined separately and summed together. Since the fixed rate payments are known ahead of time, calculating the present value of this leg...

› calculator › present_value_calculatorPresent Value Calculator - Moneychimp Present Value Formula. Present value is compound interest in reverse: finding the amount you would need to invest today in order to have a specified balance in the future. Among other places, it's used in the theory of stock valuation. See How Finance Works for the present value formula. You can also sometimes estimate present value with The ...

What Is a Zero-Coupon Bond? - The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 =...

Buy I Bonds in September 2022 at 9.62% | Keil Financial Partners Your $100 would turn into $104.81 6 months later, and still be worth $104.81 at the end of month 12. If the rate 12 months from now is not to your liking, then you could cash out your I bond in 12 months, lose the 3 months prior interest (which would be 0%), and still have $104.81. That's a 4.81% rate over the next 12 months!

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.143% yield. 10 Years vs 2 Years bond spread is 46.1 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.40% (last modification in August 2022). The India credit rating is BBB-, according to Standard & Poor's agency.

![Yield to Maturity (YTM): Formula and Calculator [Excel Template]](https://wsp-blog-images.s3.amazonaws.com/uploads/2022/01/19095826/Yield-to-Maturity-YTM-Formula.jpg)

Post a Comment for "42 present value of coupon bond calculator"