42 how to find a coupon rate

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate Annual interest payment = Periodic interest payment * No. of payments in a year. Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples Let us take the example of a bond with quarterly coupon payments.

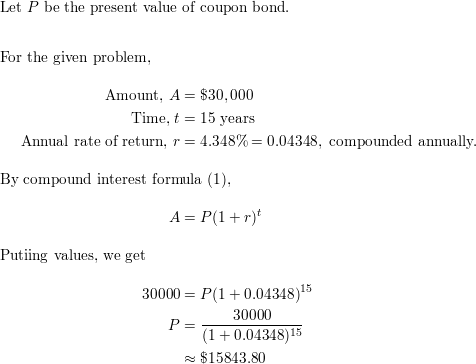

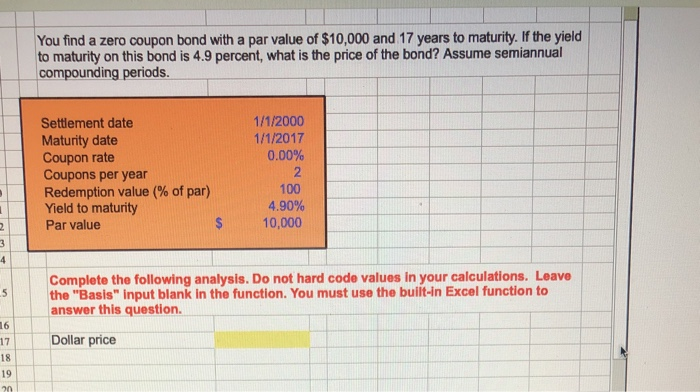

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The discount rate to use will depend on the risk associated with the cash flows from the zero coupon bond. Suppose the discount rate was 7%, the face value of the bond of 1,000 is received in 3 years time at the maturity date, and the present value is calculated using the zero coupon bond formula which is the same as the present value of a lump ...

How to find a coupon rate

Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate, these steps should be followed: Identify the par value of the bond. Usually, the par value of the bond equals $1,000. However, some bonds have par values that are... Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time! › destinations › usFind a Hotel | Hotels Near You | IHG Hotels & Resorts Please enter a destination. Your destination can be a city, address, airport code, point of interest, or zip code.

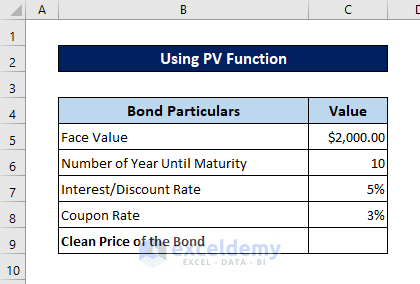

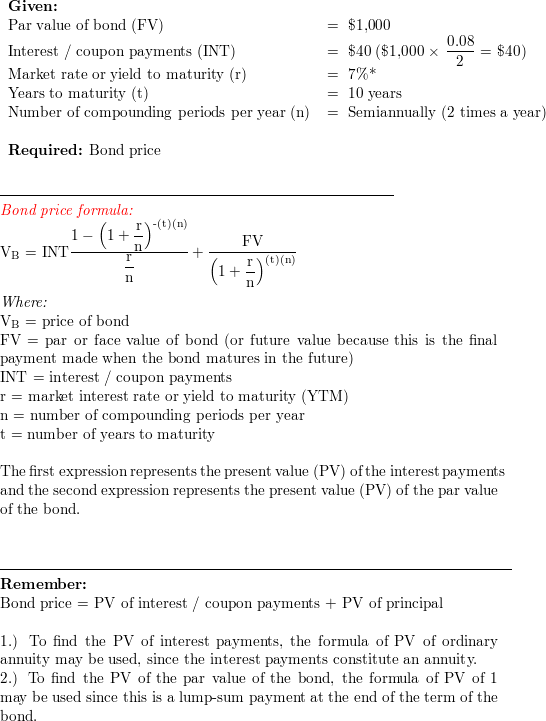

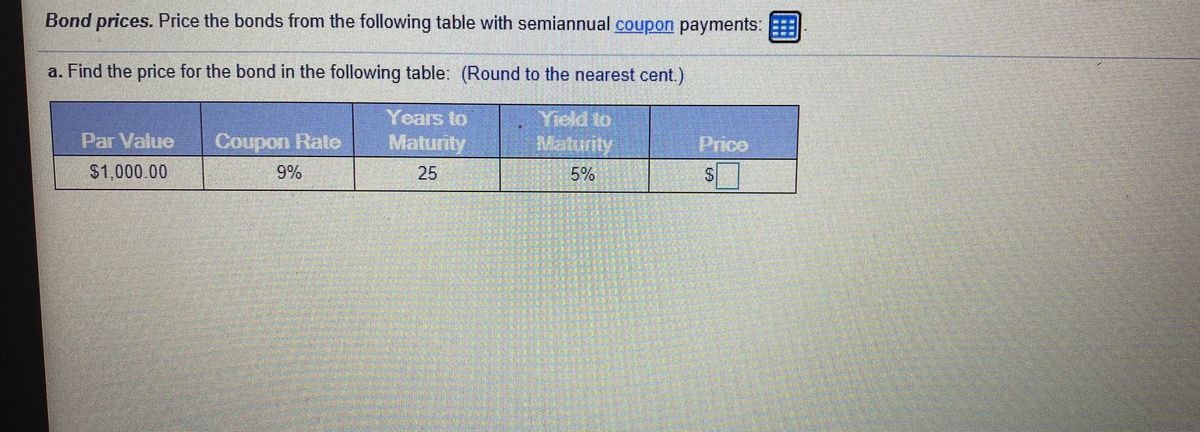

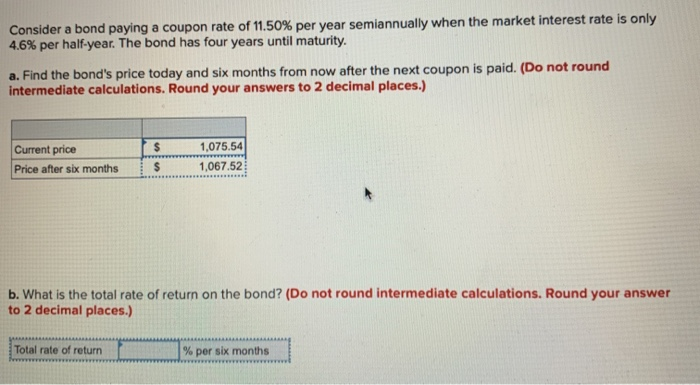

How to find a coupon rate. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value Finance Calculators Active Return What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. Coupon Rate Calculator | Solution Step by Step 🥇 The formula for calculating a bond's coupon rate is: \text {Coupon Rate} = \frac {\text {Coupon Payments}} {\text {Face Value}} The coupon rate is often expressed as a percentage, but it can also be expressed in decimal form. The relationship between coupon rates and market interest rates How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price. Users can calculate the bond price using the Present Value Method (PV). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of the bond. The par value of a bond is the amount that the issuer agrees to repay to the bondholder at the time of maturity of the bond. In formula it can be written as follows: Coupon = Coupon Rate X Par Value Coupon Rate Formula | Simple-Accounting.org How to Calculate Coupon Rate. The coupon rate, or coupon payment, is the yield the bond paid on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity. The prevailing interest rate directly affects the coupon rate of a bond, as well as its market price.Therefore, if a $1,000 bond with a 6 ...

Zero Coupon Bond Calculator - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. › ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · How to Find the Coupon Rate . In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1 ... How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The coupon rate is the annual income an investor can expect to receive while holding a particular bond. At the time it is purchased, a bond's yield to maturity and its coupon rate are the same.

What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

› design › topicsCraft Ideas | Topics | HGTV From garden crafts to holiday crafts, paper crafts to fabric creations, we've got easy handmade craft ideas for adults and kids alike.

How to Calculate Coupon Rate in Excel (3 Ideal Examples) The coupon rate is the rate of interest that is paid on the bond's face value by the issuer. The coupon rate is calculated by dividing the Annual Interest Rate by the Face Value of Bond. The result is then expressed as a percentage. So, we can write the formula as below: Coupon Rate= (Annual Interest Rate/Face Value of Bond)*100

Coupon Payment Calculator You can quickly calculate the coupon payment for each payment period using the coupon payment formula: Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50

How to Calculate ROI from Coupons & Discounts? - Voucherify Amount (e.g. $10 off), Percentage (e.g. 20% off), Unit (e.g. 2 free piano classes). Free shipping. Fixed amount. Once the coupon is created, the tracking becomes super simple. In this case, you just watch the number of redemptions. So, now there's nothing blocking you from launching next campaigns with different discounts to see how they convert.

Codes & Discount Deals UAE. Free Vouchers ... Sep 28, 2022 · VoucherCodesUAE is the first website to get verified coupon codes from all of your favorite stores. We are the most extensive and most used database for discount codes in the UAE. Our simple and effective user interface makes it easy for customers to quickly find and browse top brands and categories for the best deals.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

spharmacybg.comHealth & Pharmacy Online In-Store pick up - Free Ready for pick up by March 17 after 10:00am Get answers from healthcare professionals 24/7 with online chat as a Rite Aid Rewards member.

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Coupon Rate: Formula and Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

eupolcopps.euThe EU Mission for the Support of Palestinian Police and Rule ... EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. Ultimately the Mission’s ...

What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate - Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Below are the steps to calculate the Coupon Rate of a bond:

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%.

› destinations › usFind a Hotel | Hotels Near You | IHG Hotels & Resorts Please enter a destination. Your destination can be a city, address, airport code, point of interest, or zip code.

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate, these steps should be followed: Identify the par value of the bond. Usually, the par value of the bond equals $1,000. However, some bonds have par values that are...

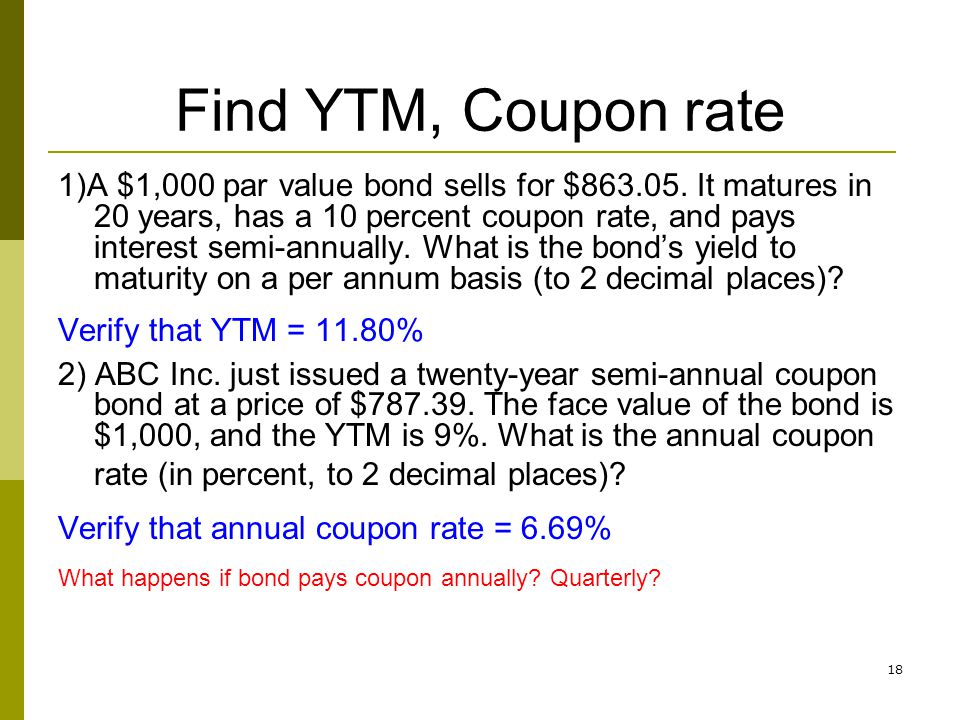

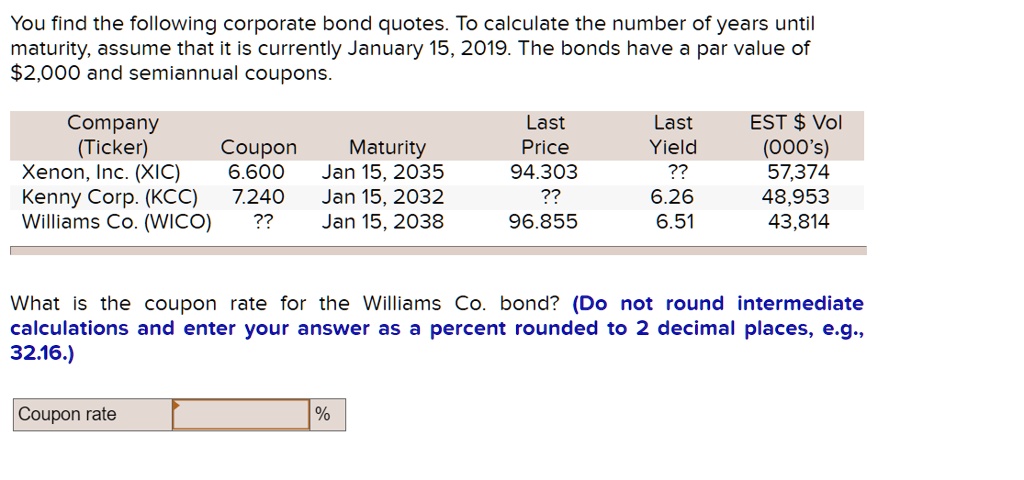

![Solved Problem 6-30 Coupon Rates (LO 2] You find the | Chegg.com](https://media.cheggcdn.com/media/8b2/8b2d21d5-5201-4261-831d-af824a31d07b/phpR0SF2D.png)

![Solved Problem 6-33 Coupon Rates (LO 2] You find the | Chegg.com](https://media.cheggcdn.com/media/f0d/f0d3e3cc-89c9-4eed-b5c1-9f247c01695c/php2LGFUe.png)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "42 how to find a coupon rate"