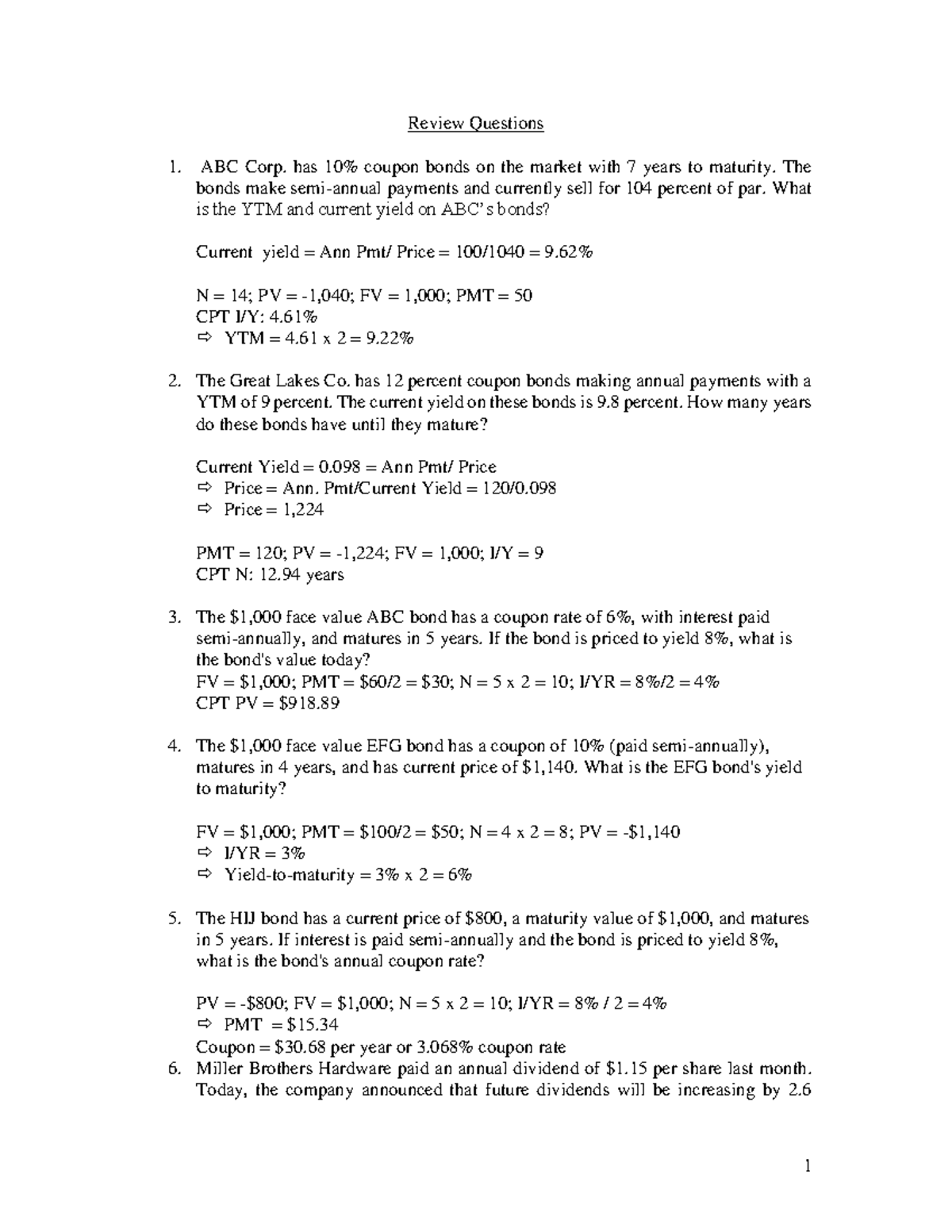

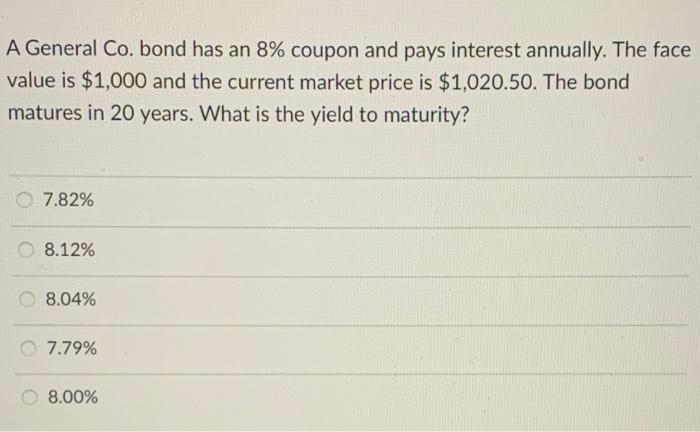

44 a general co bond has an 8% coupon

Continuous Compound Interest - Investopedia 08.06.2022 · This is potentially confusing because the effective yield of a 12% bond-equivalent yield bond is 12.36% (i.e., 1.06^2 = 1.1236). Doubling the semiannual yield is just a bond naming convention ... Asian stocks follow Wall St higher after UK calms markets 28.09.2022 · Asian stock markets have followed Wall Street higher after Britain’s central bank moved forcefully to stop a budding financial crisis. Market benchmarks in Hong Kong, Seoul and Sydney added more

Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

A general co bond has an 8% coupon

Vanilla ice co bonds pay an annual coupon rate of 10 - Course Hero 4. General Electric 30-year bonds have a 7.5% annual coupon rate and a par value of their bonds be? FV=10,000 N=30 PMT=750 I/Y=6.25%. 5. Austin Power Co. bonds have a 14% annual coupon rate. Interest is paid semi-annually. The bonds have a par value of $1,000 and will mature 10 years from now. If the ... Coupon Bond - Investopedia Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means... A General Power bond carries a coupon rate of 8%, has 9 years until ... answered • expert verified A General Power bond carries a coupon rate of 8%, has 9 years until maturity, and sells at a yield to maturity of 7%. (Assume annual interest payments.) a. What interest payments do bondholders receive each year Advertisement sleep3413 is waiting for your help. Add your answer and earn points. andromache Answer: $80

A general co bond has an 8% coupon. BA 504 - Chapter 6 HW Flashcards | Quizlet Current Yield = Coupon Rate/Bond Price. .08x 1000 = $80 80/.06 = $1,333.33 b) Less because the bond is selling at a premium. A General Power bond carries a coupon rate of 8%, has 9 years until maturity, and sells at a yield to maturity of 7%. (Assume annual interest payments.) a. What interest payments do bondholders receive each year? b. Tesco Reviews | Read Customer Service Reviews of … Tesco Jarman Park.I avoid Tesco like the plaque. We did shop there but they have put up every item they could. They have put up there own brand dog treats up by 70%. Nothing has gone up 70%. There petrol is expensive but in Southend they sell it 10p a litre cheaper. They are more expensive than independent petrol retailers. We now use Aldi. I ... Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ... Solved A General Co. bond has an 8% coupon and pays | Chegg.com A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity? A. 7.62% B. 7.79% C. 8.24% D. 8.12% Question: A General Co. bond has an 8% coupon and pays interest semiannually.

A General Co. bond has an 8 % coupon and pays interest annually. A General Co. bond has an 8 % coupon and pays interest annually. The face value is $1,000 and the current market price - Answered by a verified Tutor ... 7.79 % 7.82 % 8.00 % 8.04 % 8.12 %. Submitted: 13 years ago. Category: Homework. Show More. Show Less. Ask Your Own Homework Question. Share this conversation. Answered in 5 minutes by: 6/23/2009. A General Co. bond has an 8% coupon and pays interest annually. The ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity?... Free Press Release Distribution Service - Pressbox 15.06.2019 · IATF 16949:2016 Documents kit has been Introduced by Certificationconsultancy.com; Canadian Cannabis Company claims their cannabis cigarettesare the right way to medicate. Material Handling Equipment Market 2019; Global Nebulizer Accessories Market Research Report 2019-2024; Collagen And Gelatin Market Industry … (PDF) General Mathematics Learner's Material Department of … General Mathematics Learner's Material Department of Education Republic of the Philippines. General Mathematics Learner's Material Department of Education Republic of the Philippines. Claire Hisman. Abstract. This learning resource was collaboratively developed and reviewed by educators from public and private schools, colleges, and/or universities. We …

FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond pays an annual coupon, its YTM is 8%, and it currently trades at a premium. Which of the following statements is CORRECT? a. If the yield to maturity remains at 8%, then the bond's price will decline over the next year. b. If the yield to maturity increases, then the bond's price will increase. c. Solved A General Co. bond has an 8% coupon and pays interest | Chegg.com A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 7.82% 8.12% 8.04% 7.79% 8.00% Question: A General Co. bond has an 8% coupon and pays interest annually. Chapter 7 Homework Finance Flashcards | Quizlet d. The bond's required rate of return is less than 7.5%. e. If the yield to maturity remains constant, the price of the bond will decline over time. e***. Bond A has a 9% annual coupon, while Bond B has a 7% annual coupon. Both bonds have the same maturity, a face value of $1,000, an 8% yield to maturity, and are noncallable. A general co bond has an 8 coupon and pays interest A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in20 years. What is the yield to maturity? A. 7.79 % B. 7.82% C. 8.00% D. 8.04% E. 8.12% B. 7.82 % Yield to maturity is the annual rate of return an investor receives if a bond is held to maturity.

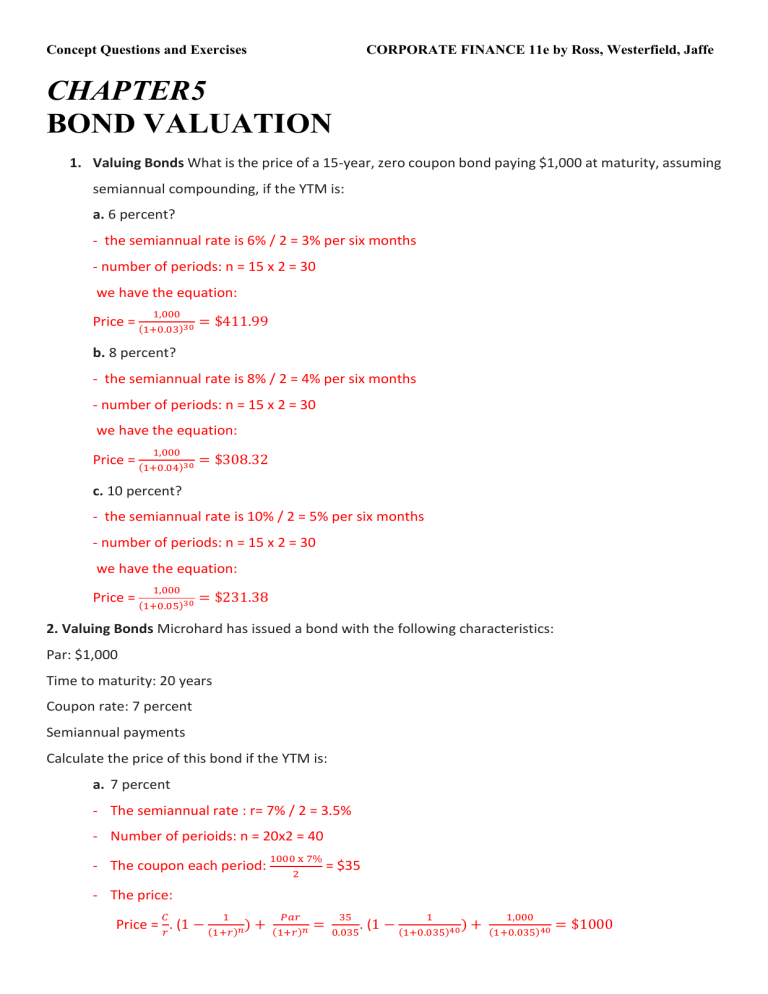

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Solved A General Co. bond has an 8% coupon and pays interest - Chegg Question: A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity This problem has been solved! You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer

A General Power bond carries a coupon rate of 8%, has 9 years until ... A General Power bond carries a coupon rate of 8%, has 9 years until maturity, and sells at a yield to maturity of 7%. (Assume annual interest payments.) (LO6-1 and LO6-2) a. What interest payments do bondholders receive each year Advertisement kennedyrlee1174 is waiting for your help. Add your answer and earn points. jepessoa Answer:

A 12 year 5 coupon bond pays interest annually the - Course Hero A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? A) 7.79% The bond sells at a premium, so its YTM has to be below 8%.

Business News, Personal Finance and Money News - ABC News 03.10.2022 · Find the latest business news on Wall Street, jobs and the economy, the housing market, personal finance and money investments and much more on ABC News

Coupon Bond Questions and Answers | Homework.Study.com Normally the coupon rates on new bonds A)do not change over the life of the issue B)are set equal to the market rate plus an inflation premium C)float with changes in the prime rate D)are set just... View Answer. Maxcorp's bonds sell for $1,223.64. The bond life is 9 years, and the yield to maturity is 8.8%.

Company A has a bond outstanding that pays an 8% coupon. The ... Company A has a bond outstanding that pays an 8% coupon. The interest is paid annually, and the bond matures in 10 years. If the market rate of interest on bonds of similar risk is 7%, what should company A's bond be selling for today? Accounting Business Financial Accounting FNCE 623 Answer & Explanation Unlock full access to Course Hero

Answered: A five-year bond, $1000 par value, 8%… | bartleby A five-year bond, $1000 par value, 8% yearly coupon paid semi-annually, and now has a 7% annual yield. Write the bond pricing equation in its 5. (1) complete form, (2) summation from, and (3) discount factor form. 4) calculate its current price and its price one year late.

Solved A General Co. bond has an 8% coupon and pays interest - Chegg A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Expert Answer 92% (12 ratings) Yield to Maturity is the internal rate of return of the Bond. It represents the amount of profit or loss on the …

A General Co. bond has an 8% coupon and pays interest semiannually. The ... A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity?...

Solved A General Co. bond has an 8 % coupon and pays | Chegg.com You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer A General Co. bond has an 8 % coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity?

bond prices and returns one bond has a coupon rate of 8 percent another a coupon rate of 12 percent 89223

Coupon Rate Calculator | Bond Coupon Calculating the coupon rate requires four steps: Determine the face value. The face value is the balloon payment a bond investor will receive when the bond matures. For our example, the face value is $1,000. Calculate the annual coupon payment

Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates ...

FIN Ch. 6 Flashcards | Quizlet a. general credit-worthiness of the issuing company ... If an American Water Company bond has a coupon rate of 9.0 percent and is selling for $920, then the yield to maturity must be: a. greater than 9% ... Baywa has an outstanding bond that has a coupon rate of 8.3%. What is the market price of this bond if it pays interest semi-annually, has ...

Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

CF Chp 8 Flashcards | Quizlet All else constant, a coupon bond that is selling at a premium, must have: A. a coupon rate that is equal to the yield to maturity. B. a market price that is less than par value. C. semi-annual interest payments. D. a yield to maturity that is less than the coupon rate. E. a coupon rate that is less than the yield to maturity

Company A has a bond outstanding that pays an 8% coupon. The... Bond cashflows are Coupon payments and Maturity proceeds Coupon payInent are semi-annual payments. Coupon payment is 2 Face value of bond'Coupon rate* (6/12) Coupon payment is = (1000*8%* (6/12)) Coupon payInent is = $ 40/. Maturity proceeds is $ 1,000].

WTOP | Washington’s Top News | DC, MD & VA News, Traffic WTOP delivers the latest news, traffic and weather information to the Washington, D.C. region. See today’s top stories.

A General Power bond carries a coupon rate of 8%, has 9 years until ... answered • expert verified A General Power bond carries a coupon rate of 8%, has 9 years until maturity, and sells at a yield to maturity of 7%. (Assume annual interest payments.) a. What interest payments do bondholders receive each year Advertisement sleep3413 is waiting for your help. Add your answer and earn points. andromache Answer: $80

Coupon Bond - Investopedia Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means...

Vanilla ice co bonds pay an annual coupon rate of 10 - Course Hero 4. General Electric 30-year bonds have a 7.5% annual coupon rate and a par value of their bonds be? FV=10,000 N=30 PMT=750 I/Y=6.25%. 5. Austin Power Co. bonds have a 14% annual coupon rate. Interest is paid semi-annually. The bonds have a par value of $1,000 and will mature 10 years from now. If the ...

Post a Comment for "44 a general co bond has an 8% coupon"